Average collection period refers to how long it typically takes to collect payment from your customers after you’ve delivered a product or services, i.e., accounts receivables. In other words, it’s the average period of time between the “sale” or completion of services and when customers make payment for a given period. The Average Collection Period (ACP) is a financial metric that measures how long, on average, it takes for a company to collect payment from its customers after a sale. It’s like keeping track of how long it takes to get a refund from that online store—except in business, it’s all about cash flow and efficiency. When examining these metrics, it is essential to recognize their differences and similarities. While ACP focuses on the length of time required to collect receivables, CCC offers a broader perspective on how efficiently a business converts its current assets, such as inventory and AR, into cash.

Improve Liquidity

- If this company’s average collection period was longer—say, more than 60 days— then it would need to adopt a more aggressive collection policy to shorten that time frame.

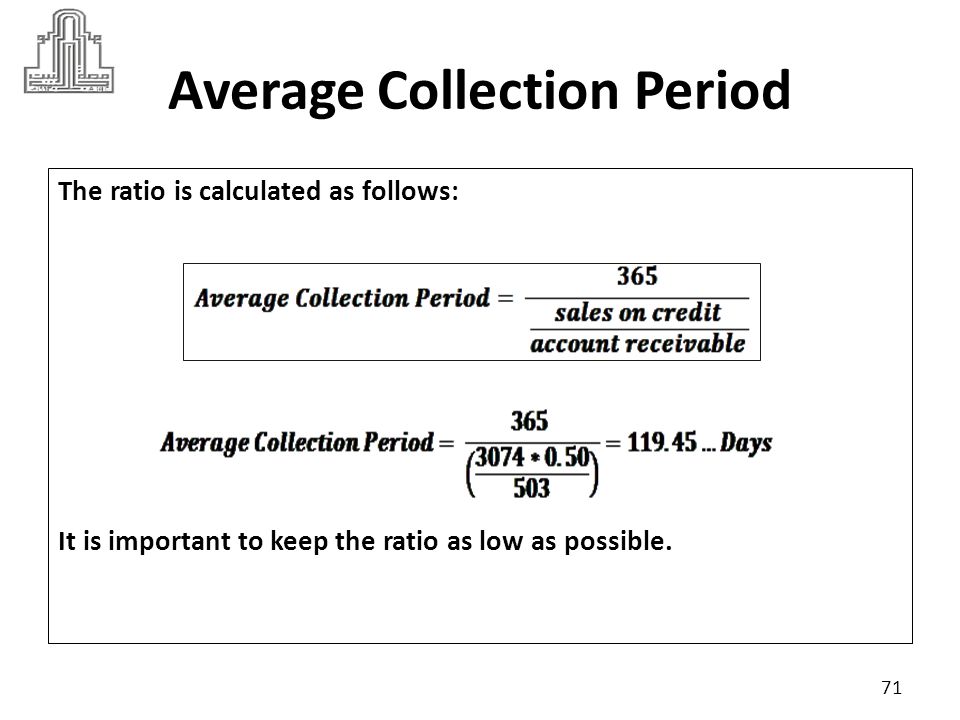

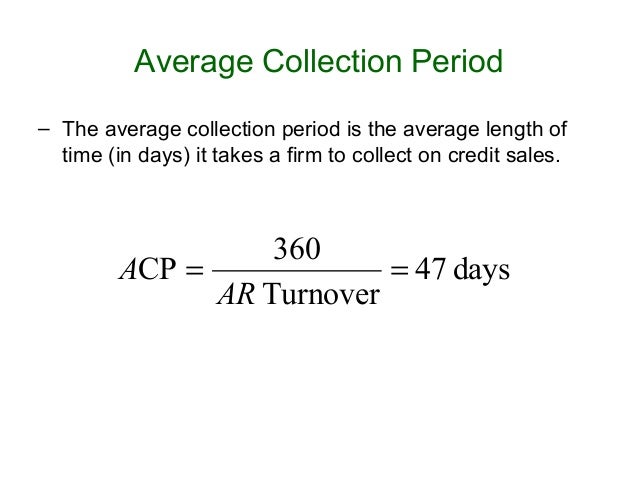

- To find the ACP value, you would need to divide a company’s AR by its net credit sales and multiply the result by the number of days in a year.

- If you analyze a peak or slow month in isolation, your insights will be skewed, and you can’t make sound decisions based on those numbers.

- A company’s average collection period is indicative of the effectiveness of its AR management practices.

The ACP is crucial because it helps businesses manage cash flow, assess credit policies, and understand their financial health. A low ACP implies that the organization is collecting payments more quickly from its customers, allowing it to generate cash sooner and reduce the risk of bad debts or aging receivables. However, lower collection periods might also suggest stricter credit terms or an emphasis on quick payment processing. In turn, a shorter CCC signifies that the business can convert inventory into sales faster while collecting those receivables efficiently.

Average Collection Period Calculator

This will help your company nail its cash flow targets and ensure you don’t end up in a cash flow crunch. Another common way to calculate the average collection period is by dividing the number of days by the accounts receivable turnover ratio. To calculate this metric, you simply have to divide the total accounts receivable by the net credit sales and multiply that number by the number of days in that period — typically, this is 365 days. That said, whatever timeframe you choose for your calculation, make sure the period is consistent for both the average collection period and your net credit sales, or the numbers will be off. An analysis of ACP and CCC is particularly useful for companies looking to compare their financial performance with industry benchmarks or competitors.

How is the Average Collection Period Formula Derived?

The average collection period may also be used to compare one company with its competitors, either individually or grouped together. Similar companies should produce similar financial metrics, so the average collection period can be used as a benchmark against another company’s performance. When analyzing average collection period, be mindful of the seasonality of the accounts receivable balances. For example, analyzing a peak month to a slow month by result in a very inconsistent average accounts receivable balance that may skew the calculated amount. Conversely, if you determine that your average collection period exceeds net 30, you may not be collecting as effectively as you should.

Here are two important reasons why every business needs to keep an eye on their average collection period. In today’s business landscape, it’s common for most organizations to offer credit to their customers. After all, very few companies can rely solely on cash transactions for all their sales. If your business follows suit by extending credit to customers, it becomes crucial to efficiently manage payment collections.

How can I improve my collection period?

While a shorter average collection period is often better, too strict of credit terms may scare customers away. It can set stricter credit terms limiting the number of days an invoice is allowed to be outstanding. This may also include limiting the number of clients it offers credit to in an effort to increase cash sales.

The average number of days between making a sale on credit, and receiving its due payment, is called the average collection period. This metric should exclude cash sales (as those are not made on credit and therefore do not have a collection period). If Company ABC traditional methods of allocating manufacturing overhead aims to collect money owed within 60 days, then the ACP value of 54.72 days would indicate efficiency. However, if their target collection period is 30 days, the ACP value of 54.72 days would be too high, indicating inefficiency in the company’s collection efforts.

But most importantly, try to avoid credit sales altogether by billing upfront whenever possible to avoid cash flow issues. Set Realistic Credit TermsStriking a balance between competitive credit terms and timely collections is essential. Consider extending payment terms based on industry standards and customer payment behaviors to encourage prompt payments while maintaining a competitive edge.